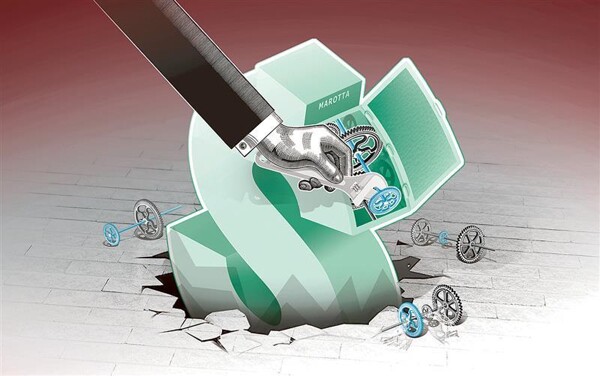

In a recent interview, Argentina's Minister of Economy, Luis Caputo, announced that the country has secured a long-term loan from private banks in REPO format to meet the debt payment of bonds due in January. The loan amount is nearly 5 billion dollars, of which part will be allocated to early interest payments and the rest to the outstanding capital. Caputo expressed the intention to return to international credit markets if interest rates are favorable, thus seeking to successfully refinance the due amount expected in July.

In addition, Caputo was awarded "Finance Minister of the Year" by LatinFinance magazine. The minister mentioned that the agreement with the International Monetary Fund will be pending for next year, once the new government is established in the United States. Debt maturities totaling 4.8 billion dollars are expected to occur next January, according to estimates from the Congressional Budget Office.

The plan consists of making early interest payments and long-term repurchase agreements with private banks to meet financial obligations. Additionally, there is a possibility of returning to debt markets in June, should interest rate conditions be favorable for refinancing new financial obligations and paying interest using the primary surplus.

Caputo explained that January and June concentrate the majority of debts maturing in 2025, and if interest rates do not allow for the planned strategy, alternatives will be sought to fulfill financial commitments. In this context, the importance of maintaining an adequate Country Risk level is emphasized to ensure the viability of future financial operations.