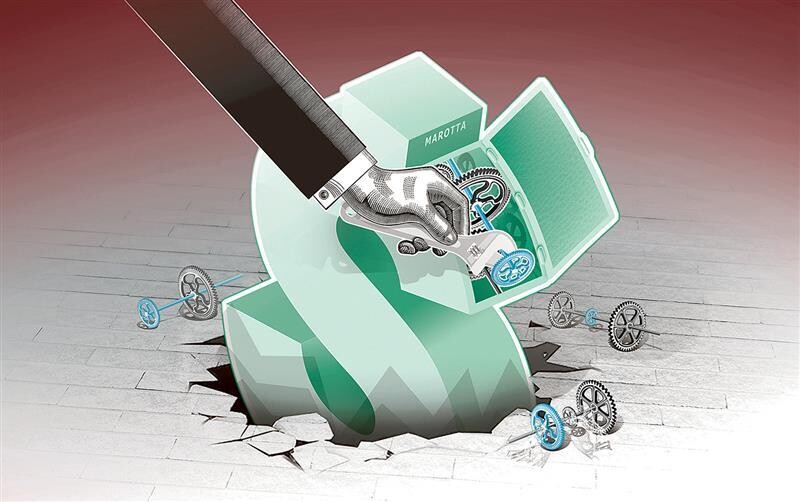

The future of the currency controls in Argentina continues to generate uncertainty. The government has been debating the possibility of lifting the currency restrictions imposed by previous administrations. Javier Milei, in his electoral campaign, promised a fiscal adjustment and a decrease in inflation as necessary measures. However, the removal of currency restrictions has been a slow process.

According to experts, the liberalization of the currency controls could trigger the entry of financial dollars, raising questions about who would be willing to lend dollars to intervene in the market at a price not aligned with the market. The free float of the dollar presents a challenge for the government, considering it a possible factor of political destabilization.

The discussion centers around the impact that removing the controls would have on the economy, with perspectives ranging from faster growth to potential negative consequences on the value of the dollar. Additionally, there is concern about the excess of pesos in circulation and their effect on the Lefi.

For some economists, maintaining the controls also entails costs, and it is questioned whether it is more beneficial to keep them than to lift them. In business and economic circles, the recurring question is when this removal will take place. Meanwhile, the government is evaluating the possible scenarios and risks associated with this decision.

The economic and political situation in Argentina is influenced by this issue, with forecasts about possible scenarios once a determination is made. Uncertainty persists, and the need to maintain fiscal balance and control inflation is presented as key challenges for the current administration.