It is expected that by 2025 inflation will reach 26.8% and there will be a devaluation of 21.6%, making it more advantageous to invest in inflation-adjusted peso bonds than in dollars, according to Salvador Di Stefano. The analyst warns about taking on debt in a context where high interest rates in pesos from Lecap greatly exceed expected inflation. An annualized devaluation of 26.8% is anticipated, placing the dollar rate at 11.4% per year.

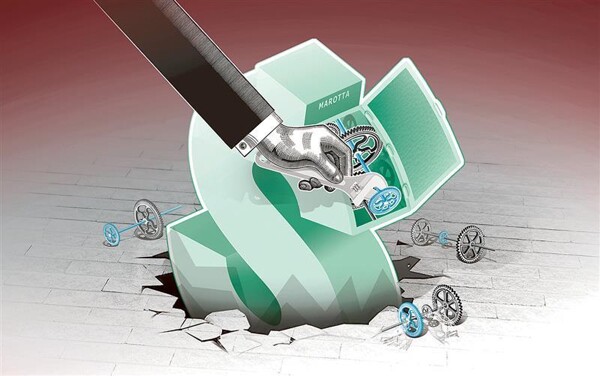

Salvador Di Stefano points out that currently it is more convenient to take a loan in dollars at a single-digit interest rate than a loan in pesos with an annual interest rate of 35%. He highlights that market rates make it more attractive to finance in dollars or save in this currency rather than going into debt. Despite this, inflation could accelerate due to adjustments in public tariffs, the specialist emphasizes.

Di Stefano predicts a stable exchange rate scenario until March 2025 due to factors such as international loans, financial agreements, and a possible understanding with the IMF. This could lead to a lifting of the currency controls and create investment opportunities in bonds. On the other hand, the rates of return on dollar bonds and Lecap show significant differences, impacting the decision to borrow in one currency or another.

The analyst emphasizes the possibility of increasing stock holdings in this context. With the expectation of a greater supply of dollars in the alternative market and a slowdown in the rate of devaluation, Di Stefano sees investment in inflation-adjusted peso bonds as attractive.

In a scenario where the official dollar is updated by 2% per month, currency restrictions remain, and the blue dollar stays at low levels compared to inflation, Di Stefano analyzes the credit market and possible debt strategies in dollars or pesos in the current economic context.