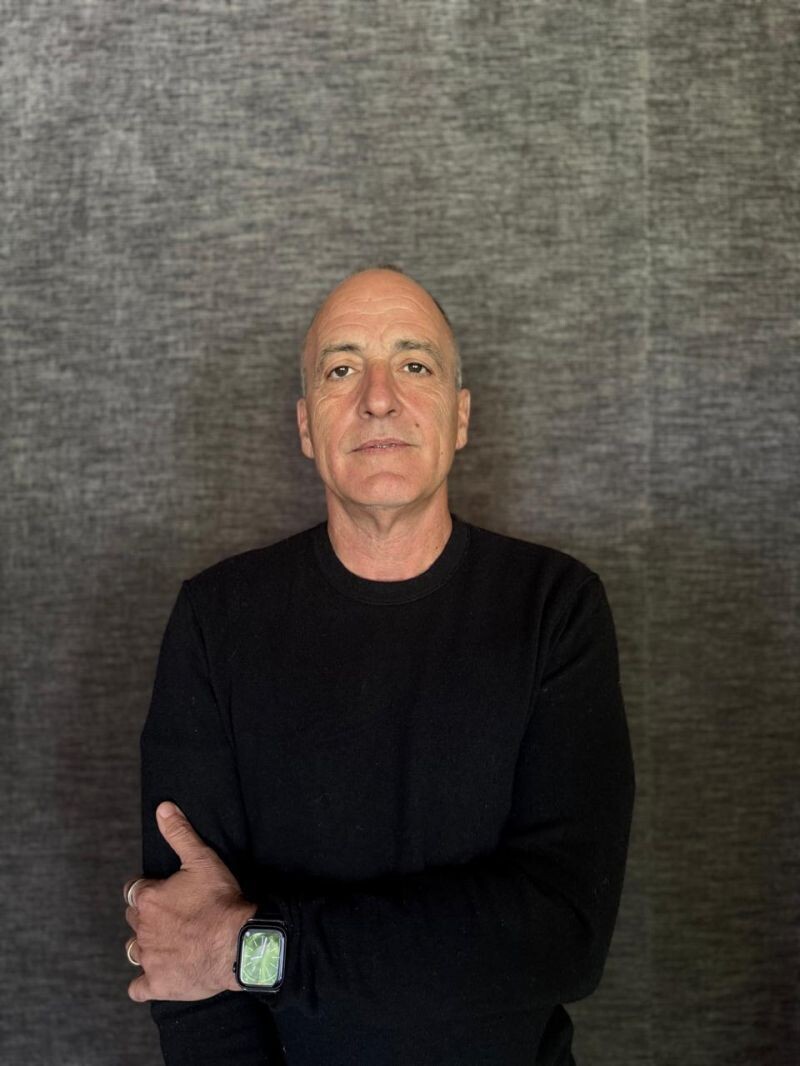

I want the company to continue operating. It has to do with trying to get the company back on its feet because it is a source of pride for Argentina. There is a value part in these companies to dismantle and break them all. I'm not saying that it won't be strategic to sell an asset of Celulosa tomorrow. Perhaps, it had a level of debt that was not ideal at that time and it was also not prepared for the things that happen in Argentina, which are the stabilization plans. What is he referring to? The rules of the game are changed for companies that have been working in the same way for many, many years. That is the prize for the Argentine entrepreneur, if he knows how to do it. When that happens, taxes can be lowered. Then, it is up to each one whether they want to pay dividends or reinvest so that the company does even better. It is a post-insolvency loan to the company, and, with that, plus the adjustments we have to make in this period that the Bankruptcy and Insolvency Law gives us, we believe that we will be able to advance the reforms we have to make so that Celulosa starts to generate positive cash flow and the wheel starts to turn. We tried to buy it when the liabilities were in order, which in Argentina is called a preventive reorganization. The backlash from this is that the Argentine industry suffers because it is not prepared to compete freely with a cheap dollar against the rest of the world. I do not want this process to continue dragging on when there is an option on the table that states that Vicentin will return to what it was and not go into bankruptcy so that its assets are dismantled or jobs are eliminated. Argentina lost the possibility of taking loans and also lost its currency. What is missing is a labor reform, followed by a tax one. Do you see it as possible? We believe that Argentina will have to resolve its dilemmas. That is the perspective that applies to both analyzing the current situation and making business decisions. That is why he focuses on what he considers will be the success index of Argentine entrepreneurship: to gain efficiency and productivity in all the group's businesses, with or without a tailwind. He has nothing to hide, he assures. Esteban Nofal, owner of Cima Investments, the fund that a few weeks ago bought Celulosa Argentina for USD 1 million. Also, he has a strategic position in the Vicentin case, since last year he acquired the debt that the grain company had with international banks, which gives him a key capital vote to resolve the conflict that has been going on for more than five years. Nofal, one of the four sons of Luis, a historic partner of Carlos Ávila in Torneos y Competencias, describes an Argentine context in which uncertainty and volatility reign, and foreign trust does not arrive. That is what we are going to try to do with Celulosa. That gives us the possibility, when convenient, to export a little. In that, we are unique. But well managed and with the right incentives. What is he referring to with incentives? That is what must be taken into account in Argentina. If I bought USD 24 billion a year, the debt would be solved, the country risk would drop to 400 points, and Argentina could issue new debt. We are not going to go into a preventive crisis procedure to try to reduce the workforce. That is part of what it is about to stay with the company. I'm quite angry about that. I don't buy companies that are not virtuous, nor do I buy to dismantle them. Today all state-owned companies make money, when before they lost fortunes. In addition, it has an added value, a business, 50% of the local market and a great potential. If the judge does not nullify my vote, which he cannot do, because there is infinite case law on that, the exits are few. Then? I think it will turn out well. But it is not a priority. So what is the first step? Part of this decision was to see if the company has value and if it can be virtuous. Then, without currency and without a lender, you only live with what you have. I'm not talking about Switzerland. How do you see the current situation in Argentina? This government has done some things that were unthinkable before its arrival, such as the fiscal surplus and deregulation. Now, with new rules, it is willing to play the game. How was the decision to buy Celulosa Argentina made? It is a company that historically had good balances and good cash generation. On my part, as the owner of Cima, the focus will be to streamline and generate productivity in the companies in which we invest. This requires changing ideologies and ways of working that have been carried out for many years. The reality is that we are going to try to streamline and, if this leads us to have to make that decision after a certain amount of time, we will do so. It is a trading currency but not a savings one. You have to take care of working capital, but stocking up no longer serves, so you have to work efficiently and, all of that, giving shareholders their dividends. What are the incentives that the country makes you force. Otherwise, the fiscal deficit would reappear. What should happen in the country in the coming years? It is necessary to create a bridge between today's Argentina and the companies of the future until 2027, but floating high. Otherwise, they would have to import and paper is heavy and takes up space, it is volumetric. What future do you see for the company? My way of entering is that it is not necessary to break it. In that, there is a lot of productivity to be gained in Argentina. When he refers to streamlining, changing ideologies and ways of working, is he thinking of laying off personnel? Always, the ones who suffer the most from a crisis are the company's workers. However, that the dollar is cheap in Argentina means two things. What? First, that people always buy it, because no Argentine saves in pesos. No matter how much an Argentine earns, he will always save in dollars. On the other side, there is the capital account, which we see that dollars are fleeing. So, if 30% is incorporated into the economy in white via work, the collection mass grows. Being a trading currency, when it is cheap, people perceive it. What I believe is that the country has to float high until the bridge is made. But the internal market tends to have better prices because, due to the company's own structure and its ability to generate stock, working capital is reduced for distributors and bookstores. But first, we have to see what business we have, how efficient it is, what the margins are, where we are losing, how we can streamline, where we can make investments, and in the middle, we have to discuss the issue of debt. And although the situation will normalize in the medium term, obviously, turbulence and volatility will exist. What makes you think of an improvement? We have already gone through the attempts in which the United States and Spain, for example, are immersed. He understands that the present is difficult and that overcoming it will require effort and sacrifice, but that at the end of the road, he knows he will be rewarded. But at this time, we are not considering reducing personnel. In addition, the vote that the debt I bought gave me was the homologation and I did not change it. With a fiscal surplus and an income of between USD 1,000 and 2,000 million per month in the current account, the problem is over. I am not negative, I am buying companies in Argentina. The dollar must have the level of exchange rate that allows buying USD 2,000 million a month in reserves. But mainly, we are trying to reform internal processes that are also facilitated in times of crisis. I try to buy companies to get them back on their feet, as in the case of my investment in Vicentin. The case of Aerolíneas Argentinas or YPF. There are things that are essential in this case and that is the fact of going through the bad moment as quickly as possible. The one in Zárate, meanwhile, has some problems for now. Does Celulosa export again? We are already planning a shipment to Brazil. To say that someone cannot buy a debt after a company has been reorganized and that for that reason they do not have the right to vote, is a nonsense. But he does not regret betting on the country. However, these things can be done in a virtuous way. In this case, we had to make a very important cash contribution to get the company back on its feet and start generating cash flow. It is a company that bills close to USD 200 million a year, so it must have adequate working capital to start operating. There is no other option because there is no money and no one is willing to lend. I don't see them (N.d.R.) They told us it would be all better and it wasn't. I am betting on Celulosa for three or four years. It can be achieved because companies in Peru, Paraguay achieve it. Now we know that we have to make an effort and it hurts. He answers the phone and assures that, in the way he speaks with this journalist, he does it with his peers, his employees, the judges and even the unions. There is a lot of talk about the reconversion of the Argentine industry. He reaffirms, on this basis, that there is a country model that is left behind and that is the one in which custom, low control and, of course, economic disorder reigned. We turned on the machines of the plant in Capitán Bermúdez, which are already working at full capacity. It will be very difficult not to seek business efficiency. I don't charge absolutely anything from Celulosa and I don't intend to do so until I can distribute dividends. Last week, Molinos Agro and LDC presented a request to challenge his vote in the Vicentin case. Trips abroad exploded because perhaps it will not happen again in the next five years; this is USD 5,000 million a month that are fleeing. The second part is to define how we can improve productivity. The commitment we took, together with investors (some from abroad, from my Wall Street days, and others local), was USD 18 million. Obviously, I want to make a good business. Once the homologation fell and it went to cramdown, I have the right to make the agreements I want with whomever I want. Labor reform is essential because 50% of the economy is in the black. That is the formula. In fact, it has already begun. Either the cramdown will be in favor of Grassi or Vicentin will go to bankruptcy. Beyond the reforms that will have to come for the country to be viable, this reconversion was forced too much and, in general, it is difficult to adapt without good planning. Now we are in a stage of clarifying the company's possibilities as to what it can pay in the future. A businessman, son of a businessman. What is his opinion on this and what exit does he see for the cramdown? It was a legal nonsense. All the actors agree that we want a virtuous exit, that Vicentin gets back on its feet and works as it was before. This does not mean that he should not be harsh in the analysis or in making difficult decisions. It is one of the few plants in the planet that makes from pulp to paper: we receive the tree and deliver the final paper. Silent, stealthy and low profile. Rates are not going to be negative, but positive. Grassi is very close. He agreed with Bunge and Cargill.