The liquidity of the funds reflects that we are heading towards a large-scale crisis not seen in 25 years (since the dot-com bubble) and being liquid in that process is worth gold,” says Compagnucci. He believes that politicians should take note of the strategies of large funds to anticipate what is coming. Along similar lines, Estrada argues that “this strategy leaves us with a valuable lesson: closely following experienced investors can help us make better financial decisions.

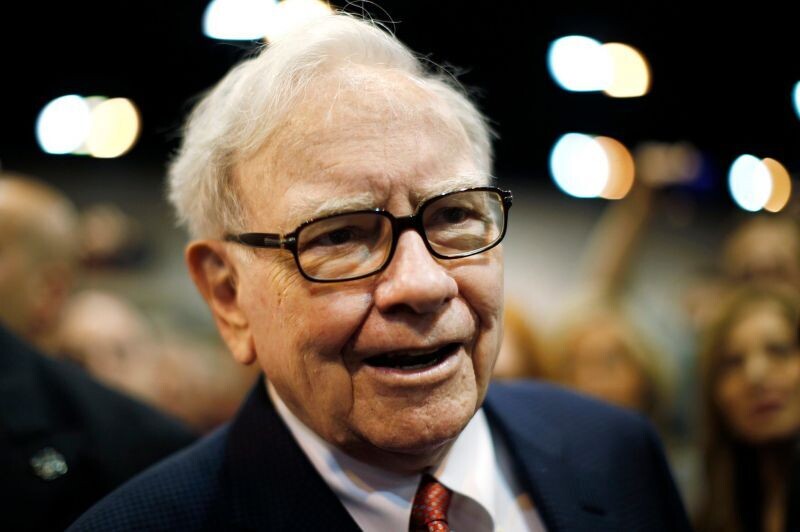

For Jorge Compagnucci, director of content at TMG, Warren Buffett's liquidity holdings, which have surprised the financial world since January 2020, are a wake-up call because they forecast a stronger decline than what was experienced during the pandemic. “The world today is not the same as it was years ago; the trade war will worsen the global crisis, and the world is approaching large-scale stagflation. In this context, the world is strengthening its aversion to risk, and we need to increase our position in liquidity in general,” he asserts.

It happens that large investors see that in these market moments, having cash for upcoming opportunities is a valid trade. “In that strategy, Argentina, which had been performing extraordinarily, was the perfect target to unwind positions,” he states. However, he believes that it is not such a bad scenario for the country, despite increased risk aversion, in case it wants to refinance debt because “the Federal Reserve is going to cut rates and bond yields have fallen.” “That -says Neffa- provides better prospects for entering the voluntary debt markets in June.”

This is because their investment policy is to buy very good companies at bargain or attractive prices, but, about a year and a half ago, they began to notice valuations above historical averages and started accumulating cash in anticipation of new opportunities,” says the director of Guardian Capital, Tomás Ambrosetti. “This liquidity increased during 2024 when, rather than making purchases, they sold positions in which they were invested, and now, other similar funds are also accumulating cash to take advantage of good buying prices for stocks if these declines from the past few weeks persist,” explains Ambrosetti.

“Buffett often emphasizes having liquidity due to his 'Value' philosophy, but for months now he has been indicating that a recession may be coming, which led him to adopt this position in an even more aggressive manner. The availability of cash is important in an uncertain scenario, both to avoid price drops and to take advantage more quickly of 'bargains' that may arise in a bear market,” explains Matías Fernández, equity strategist at Aurum Valores.

“The markets have been shaken by Trump’s tariffs and his bombast, coupled with already poor macroeconomic data and high valuations. “Staying liquid is very interesting to wait for the opportune moment when the uncertainties of the agreement with the IMF and other imbalances may become clearer and the trend can be better read,” suggests Ambrosetti. In that context, Fernández points out that “Argentina has the volatility inherent to our market, which is compounded by a very uncertain context due to Trump and his measures, the impact on commodities, and the reactions in global stock markets...

Estrada highlights that Berkshire Hathaway's strategy of accumulating liquidity is a topic of inquiry in the markets and questions why Buffett accumulated cash and missed an equity rally. “He has reinforced his leadership lately with a very good balance,” as now, with a sharp correction in stocks, his idea of liquidity starts to bear fruit and many funds have begun to imitate him. Estrada indicates that the expectation of corrections in international financial markets led Buffett to prioritize liquidity over exposure in stocks.

Geopolitical uncertainty and protectionist measures influence Berkshire's strategy. “It is important not to lose sight of the medium- and long-term perspective that investments in stocks require,” he states. With $334 billion in cash, Berkshire Hathaway has 28% of the company’s value in liquidity. Warren Buffett remains a successful and respected financial reference globally.