The money laundering has provided the Government with significant relief, with an influx of $13.1 billion just in September. This poses a crucial dilemma about the long-term sustainability of the current exchange rate regime. There are two possible paths to follow in 2025: maintain economic stability through measures such as orderly devaluation or face instability risks that could lead to a disorderly devaluation close to elections.

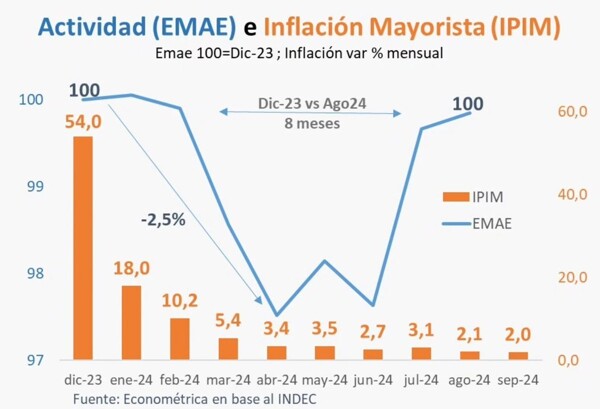

The combination of variables such as prices, dollar, and fiscal surplus has shown positive behavior, generating a sense of stability in the economy. However, challenges and weaknesses in the economic program that need to be addressed for achieving a stable macroeconomy and constant improvement in social indicators still persist.

The influx of capital into the financial system and the reduction of country risk to 900 basis points are encouraging signs, but it is crucial to analyze the sustainability and costs associated with the current economic model. The need to maintain a balance between currency appreciation and competitiveness is a central discussion point that must be approached with caution.

The temporary stability experienced in the economy, supported by transitory factors, raises uncertainty about the future and the direction that economic policy will take. Key decisions such as closing agreements with organizations like the IMF could be decisive for the evolution of the exchange rate and competitiveness in the international market.

The current currency appreciation has had significant impacts on competitiveness, inflation, and exports, which requires a deep analysis of short-term and long-term implications. The need to implement measures that promote sustainable economic growth and financial stability is urgent to avoid future crises and foster balanced development.