BMW's CEO, Ivana Dip, indicated that on average car models pay 60% in taxes in Argentina. Despite the limitations imposed by the currency controls, importers have managed to reduce the payment terms from 180 to 90 days, allowing them to introduce more models into the Argentine market. However, the internal tax remains a determining factor in the final price of vehicles.

Currently, the internal tax for vehicles in Argentina is 25% in the first bracket and 54% in the second, percentages established with an exchange rate gap of 100%. To avoid an almost 80% tax increase, automotive manufacturers have adjusted their price lists, placing models on the border of the first scale.

A study by Motor1 revealed that, despite the reduction in tax, Chevrolet has increased its prices by an average of 1.6%. In contrast, Peugeot and VW maintained their prices, while Toyota stood out with an average reduction of 4%.

Chevrolet is positioned as the brand with the highest price increases for locally-produced vehicles, with an average of 2%. On the other hand, Renault was the one that reduced prices the most, reaching an average of 8.9%. The tax payment mechanism, which includes an advance of 95%, has led to vehicles displayed at dealerships being nationalized, paying a tax equivalent to 16.62% of their value.

The increase in tax pressure on car prices in Argentina is exacerbated by the PAIS tax, which affects imports. These taxes, combined with other production taxes, represent 11.6% of the manufacturing cost of a medium sedan, according to Adefa. In comparison, in Brazil this tax burden is 7% and in Mexico 0%.

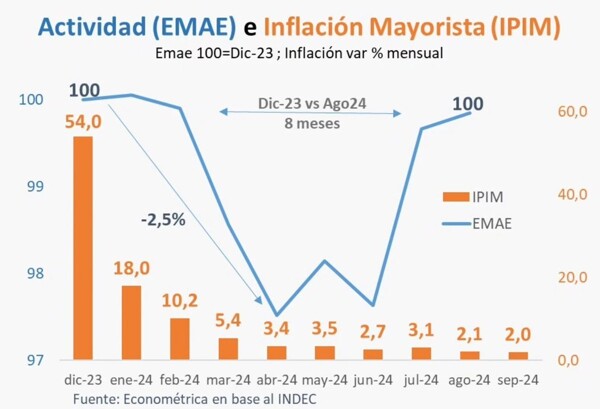

Following the devaluation and the increase of the PAIS tax, car prices have risen by 196.1% between January of this year and the same month in 2023, below the overall price increase recorded by Indec. The RIGI, acronym for the Regime of Incentive for Large Investments, could reduce the price of a car by 60%. Adefa indicates that the tax burden on a vehicle manufactured in Argentina reaches 58.09%, while for commercial vehicles such as pickups, the burden is 47.59%.

In summary, taxes represent a significant burden on the final cost of vehicles in Argentina, which, combined with other costs, impacts prices for consumers.