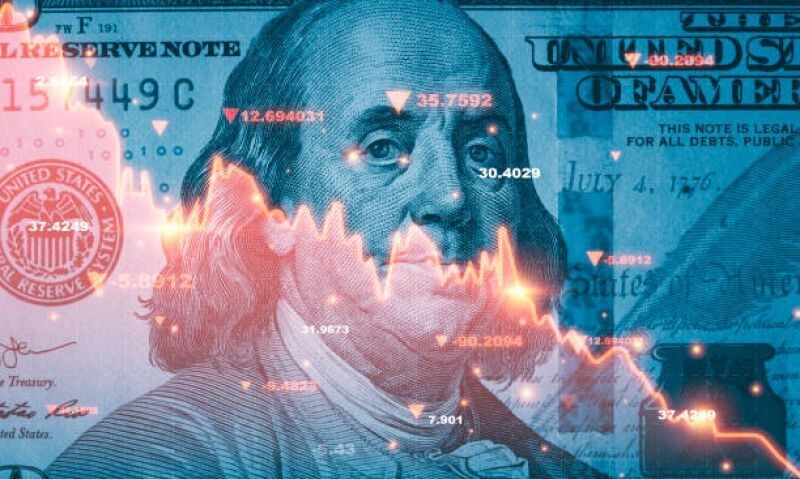

Sovereign bonds worldwide had a very negative performance, except in Argentina, where a significant shift in trend occurred. The Merval recorded a return in dollars of 10%, indicating notable interest in Argentine assets. This phenomenon seems to reflect an international market that is becoming interested again in the possibilities of change in Argentina. The proximity of the presidential elections in the United States also adds uncertainty to the future economic dynamics of the country, especially if Trump's victory materializes, as Wall Street anticipates.

In this context, the deficit in the United States has reached 6.30% of GDP in the third quarter of 2024, showing a tendency to live beyond its means and to resort to Keynesian deficit. This situation is perceived as a very Peronist version of economic policy by the U.S. government. Since mid-September, Argentine sovereign bonds have experienced an impressive rally, while long-term U.S. bonds have had a downward trend, reflecting inverse interest.

The Argentine country risk has decreased below 1000 points, being a minimum since the PASO of 2019. This optimism combines with the assessment of debt in relation to the GDP of the United States, which could exceed 100% in the next two years, a figure not seen since World War II. These movements in the financial markets suggest a migration of assets toward anything except paper currency, including Argentine assets.

The presidential election in the United States generates expectations of continued rising in non-monetary assets. The constant indebtedness and deficit in the United States, along with the populist policies of its candidates, has led to a valuation of hard assets as a financial refuge. In this global context of monetary dilution, the perception of the Argentine peso as expensive or cheap becomes relevant for investors.

The uncertainty surrounding future economic policies, both in the United States and internationally, keeps financial markets on alert. Possible economic stimulus measures, such as eventual Quantitative Easing by China, could generate unexpected reactions. In this scenario, the position of investors in intrinsic value assets becomes crucial to protect against monetary devaluation. The global economic situation reflects a search for shelter against uncertainty and could benefit Argentina in sectors such as soy and other commodities. Regardless of the outcome of the elections in the United States, the current economic paradigm demands a strategic and cautious vision for investors.