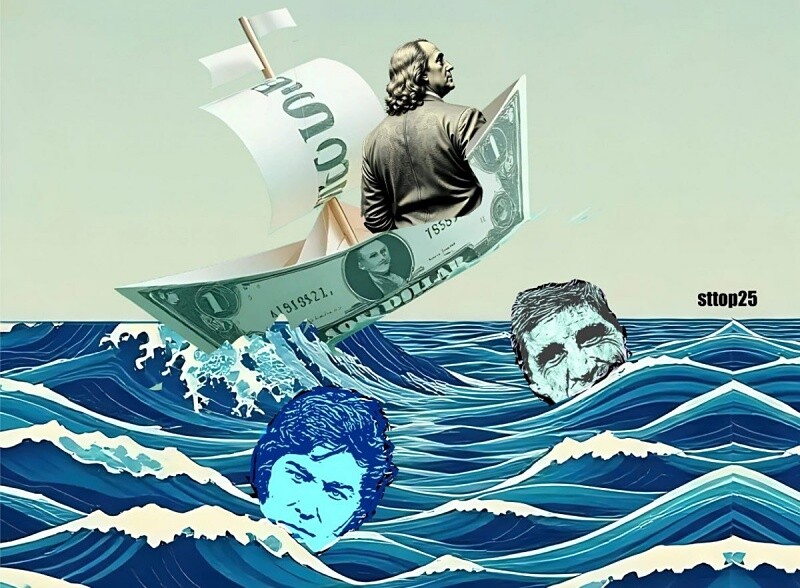

Argentina’s new administration under Milei and Caputo faces serious economic risks that could loom over the country in 2026. The main issues are a lack of foreign‑exchange reserves, a current‑account deficit, looming debt maturities, and a rising dollar‑demand. Without substantial external financing, the sustainability plan is under threat.

The government attempts to offset this by opening debt markets to attract investors, yet the restrictive provisions of the Guzmán Law cast doubt on credit availability. Analysts stress that success hinges on long‑term structural agreements, such as those with the U.S. and the EU, but their implementation is not guaranteed.

Budget debates reflect that fiscal adjustments may be too harsh, impacting sensitive sectors such as health and education. This raises the risk of losing public confidence, which is critical for policy sustainability.

Domestic currency demand outpaces official intervention capacity, and the central bank’s reserve funds are in a precarious state. Without a significant influx of external resources, the economic balance appears unlikely to hold.

Based on all data, economists conclude that if the country does not find a sustainable source of financing, the risk of an economic crisis in 2026 becomes increasingly realistic.