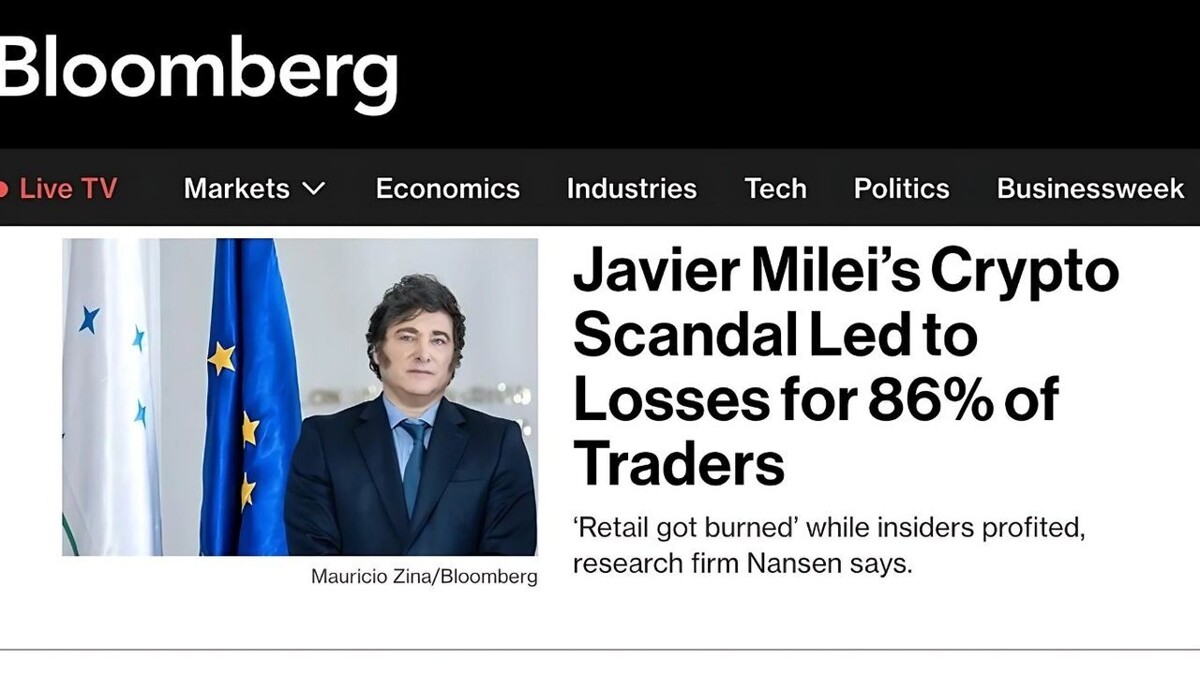

The report published by Bloomberg revealed that 86% of the operators who invested in the memecoin $LIBRA, initially promoted by President Javier Milei, suffered million-dollar losses. According to data from the crypto analysis firm Nansen, a small number of wallets managed to make profits while the majority of traders faced significant losses.

In its early days, LIBRA had a market valuation of $4.5 billion, but it began to plummet when Milei deleted his promotional tweet about the project. Since then, the value of the cryptocurrency has fallen by 20%, reducing the total tokens locked on the platform from $12.1 billion to $8.29 billion.

Hayden Davis, CEO of Kelsier Ventures, one of the firms involved in the launch of LIBRA, admitted that the token was merely a memecoin, despite the initial idea of using it to finance small businesses in Argentina. In light of the scandal, speculation arose on social media about a possible hacking of Milei's account or a scam in which the president may have also fallen victim, as the token had already lost 80% of its value at that point.

The negative impact extended to the Solana network, the platform hosting the token, with an estimated loss of $251 million and only a small group of operators managing to pocket $180 million. According to the Nansen report, which analyzed more than 15,000 digital wallets, it was discovered that a group of "insiders" made profits before the asset's collapse.

Meanwhile, as the government attempts to distance itself from the controversy, the crisis of confidence in crypto markets continues to rise. Javier Milei stated that he was not informed about all the details of the project and that, after learning more information, he decided to stop promoting it.