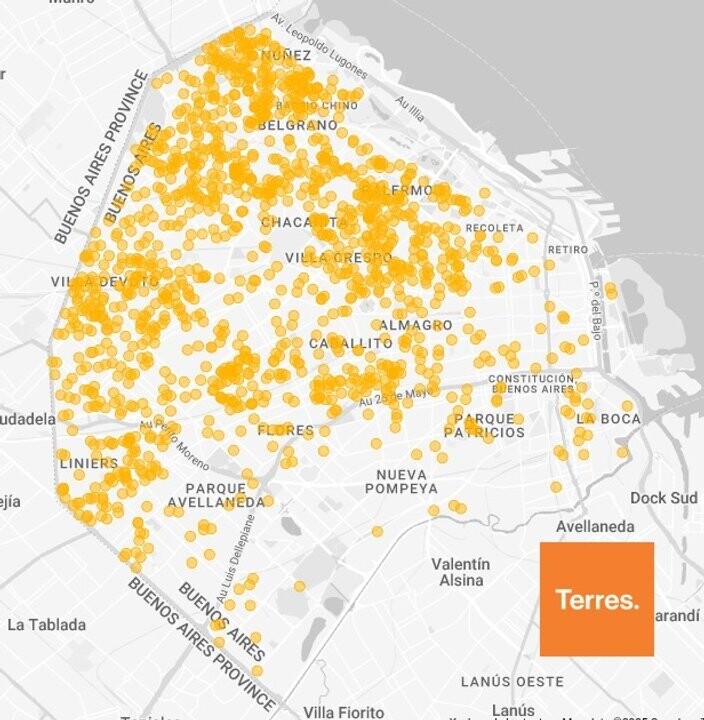

In 2025, Palermo led again, but with a notable expansion in neighborhoods like Villa Urquiza, Devoto, and Saavedra, which showed annual growth of over 130%. In terms of relative expansion, Almagro and Mataderos were among the neighborhoods with the highest percentage growth, even though their absolute figures remain moderate. The combination of available land, favorable regulatory frameworks, and sustained value appreciation enabled the opening of new territories for urban investment. That Palermo and Belgrano continue to lead is expected; the novelty is that neighborhoods like Devoto, Saavedra, or Villa Urquiza are competing with—and even surpassing in some indicators—the traditionally central districts. Thus, the map of construction permits serves as an early X-ray of the city being built: a more dispersed Buenos Aires in investment terms, with new centers of real estate gravity and areas that, for now, continue to wait their turn. The geography of brick has already started to change silently. Neighborhoods like Parque Patricios, Barracas, and Nueva Pompeya are not among the main focuses of new construction, despite the incentives incorporated since 2023 in the new Urban Code project. Although Palermo, Belgrano, and Caballito maintained their prominence, Villa Urquiza, Devoto, Saavedra, Flores, and Mataderos began to stand out strongly as new poles of vertical residential development. The neighborhoods leading in growth. In 2024, Palermo headed the ranking of new constructions with 69 projects and over 170,000 m², followed by Villa Urquiza, Devoto, Caballito, and Belgrano. Buenos Aires, December 31 (NA)—The dynamics of construction in the City of Buenos Aires underwent a profound transformation in the last five years, marked by the pandemic, political changes, and regulatory modifications that redefined the map of urban development. Far from concentrating only in traditional neighborhoods, activity began to expand into historically marginalized areas, configuring a new real estate scenario. According to an analysis by Federico Akerman, director of Terres, a platform specializing in land, the evolution of construction permits allows for precise anticipation of how the porteño territory is being reconfigured. Although a permit does not imply immediate work, it does represent a concrete signal of investment and the type of city beginning to take shape, learned the Argentine News Agency. The period was marked by two structural milestones: the change of national government after the 2023 elections and the proposal to modify the Urban Code presented in 2024, which generated expectations for new rules of the game for land use, private investment, and infrastructure. A cycle in three stages. The first moment occurred between 2020 and 2021, when the pandemic paralyzed activity, but gave way to a strong subsequent rebound. This rebound was driven by accumulated projects and the rush of developers due to regulatory uncertainty. The third period, 2024-2025, consolidated the levels of authorized surface area, but with a key novelty: the territorial change. Neighborhoods like Villa Urquiza, Devoto, and Saavedra ceased to be peripheral alternatives to become protagonists of the construction boom, with projects of intermediate scale and typological diversity. Belgrano, for its part, consolidated its profile for larger-scale and higher-value developments, a logic also replicated in Colegiales and Villa Crespo, where the quality of the final product weighs more than the quantity of works. In contrast, the southern area of the city remains on the sidelines of the process. The lack of mortgage financing appears as one of the main factors limiting the market's shift toward those areas. A city that is reconfiguring. The shift in real estate development does not imply a capital retreat, but a geographical redistribution. In 2021, with historically low dollar values, accessible construction costs, and whitewashing programs, more than 1,000 permits were authorized and nearly two million square meters, marking one of the sector's most dynamic years. Between 2022 and 2023, activity showed erratic behavior. In 2022, a 19% drop in approved surface area was registered, while in 2023, the largest authorized volume since 2018 was recorded. The availability of land and regulations allowing progressive densification explain this phenomenon. A north that expands and a south that waits. The analysis shows that so-called north corridor has expanded.